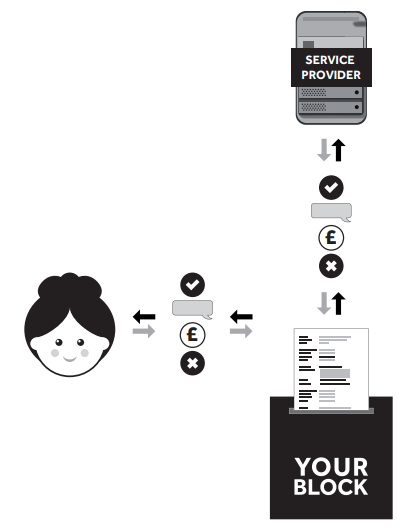

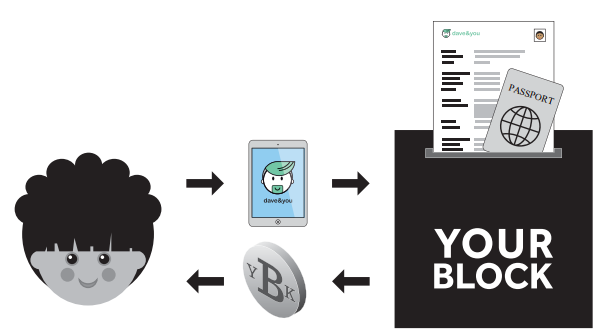

A Blockchain based Digital Filing Cabinet, which enables the consumer to securely store, control and manage their data.

YourBlock combines the security, privacy and scalability of private storage with the data integrity, immutability, and accountability of the public Ethereum Blockchain,

YourBlock will hold provider’s pricings for their products and services.Consumers can request quotes without their data leaving the platform. Consumers will be rewarded with discounted products and services, and then be rewarded with YBK Tokens for using the platform.

YourBlock enables the consumer to: interact securely with third parties; take up services; manage paperwork; communicate and record communication.

YourBlock, aiming to be the fi rst Blockchain based comparison and incentivised based Personal Data storage platform Allowing the consumer secure access to quotes for products and services when the consumer wants Smart contracts between the consumer and service providers completed on the Blockchain.

YourBlock will store the consumers’ personal and sensitive data on its own private Blockchain; it would be too dangerous to store it on the public Blockchain. YourBlock will “anchor” to the public Ethereum Blockchain to prove/achieve immutability and data integrity, without making the data itself publicly visible. The consumers’ data will only be visible to permissioned participants on the private YourBlock Blockchain.

YourBlock will provide consumers with the power to control their personal data, and freewill to choose who, and when to engage with. We intend to put consumers in a position where they have control of their data, have the ability to easily communicate transparently with service providers, and to eliminate any confusion surrounding the contracts both parties enter into.

YourBlock will not only be of benefi t to the consumer, but will also help service providers on the YourBlock platform. Provided these service providers aren’t taking personal and sensitive data from other organisations, they will no longer need to spend excessive amounts of money on highly secure IT infrastructure. They will no longer need to hold their customers personal and sensitive data on their systems. Insurers will no longer have to pay excessive costs to software houses for the set up and maintenance of their underwriting guides.

YourBlock will allow both consumers and service providers a secure area to transact business, to manage that account securely throughout the contract term.

The YourBlock platform will off er several benefi ts to both consumers and service providers:

Consumer benefi ts:

- Financial savings by sharing commission/origination fees earned by YourBlock, through simple price comparisons and alerts, and through smart tracking of spend on services

- Time savings and convenience by only having to maintain and share a single Blockchain digital fi ling cabinet, and by using smart contracts for simplifi ed claims, modifi cations, cancellations and renewal processes

- Higher data privacy by controlling who and when service providers get access. Limiting access to only the data absolutely necessary to off er the service

- Greater transparency on comparable services and on policy/ contract terms

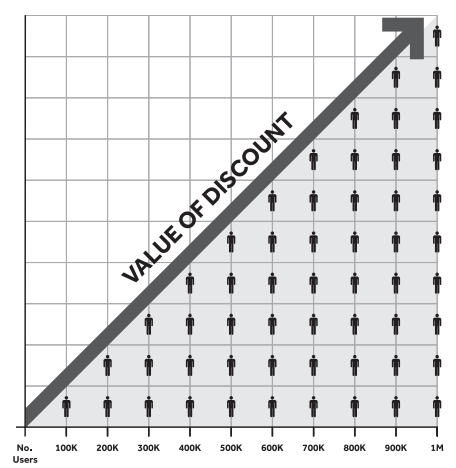

- The more users on the platform the greater the chance to get better deals with the service providers for their products and services.

Service Provider benefi ts:

- Improved consumer data quality, kept up to date post onboarding

- Automated compliance with the EU’s new complex GDPR (General Data Protection Regulation) data privacy regulations

- Cost savings and improved customer experience enabled by the automation of onboarding and claims, modifi cations, cancellations and renewals of policies/contracts.

- Reduced insurance fraud through the use of automated smart contracts

There are several additional benefi ts to related parties in each industry. For example, in the Insurance space, the following parties will also greatly benefi t from YourBlock: re-insurers; industry watchdogs; brokers; regulators and law enforcers.

Concept

YourBlock is aiming to be the fi rst Blockchain based comparison and incentivised Personal Data storage platform. A Blockchain digital fi ling cabinet, designed from the ground up to address the need of consumers to have somewhere safe and secure to store their data, data that they use on a daily basis to manage their dayto-day lives.

Think of YourBlock as that drawer at home where you keep all your Insurance documents, utility bills, passport, driving licence, bank statements, and other personal documents. YourBlock is addressing the very real need under GDPR, which comes into force May 25th 2018 for secure data protection across Europe and also in accordance with similar legislation across the rest of the world.

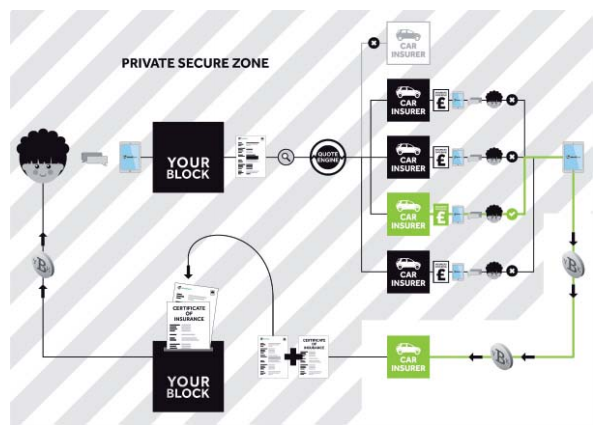

YourBlock will off er consumers a single secure digital fi ling cabinet for their personal information, which can be used to quickly obtain product and service quotations. Thereby avoiding the usual indefi nite (and often unknown) sharing of their data with data traders and other unknown third parties. Consumers will always control their data and who has permission to access it or a subset of it.

Purchasing a service will result in entering into transparent smart contracts with a selected service provider, which will greatly simplify subsequent claims, modifi cations, cancellations and renewals.

As consumers complete the onboarding process and verify their KYC (Know Your Customer) they will be rewarded with a small amount of YBK tokens. To incentivise the consumer to add more data they will be rewarded with a further small amount of YBK tokens. This process will continue throughout the lifecycle of consumer platform usage with token incentives to keep data up to date and clean. On completing a purchase with a service/product provider, they will also be rewarded with YBK tokens.

Consumers will onboard with the application by interacting with an AI-enabled Chatbot: Dave. Dave will facilitate the process of adding/updating personal information, requesting quotations and entering into contracts with service/product providers. Consumers will also be able to track all their policies/contracts and spend from a simple dashboard that integrates seamlessly with their bank account(s).

Consumers will be safe in the knowledge that their data is secure and that they will not be marketed to, or have their data sold on.

Thanks to YourBlock, consumers will enter their data once, in a secure location, controlled, managed and kept up to date by the consumers’ themselves. YourBlock returns quotes without the Service Providers receiving access to any of their information. It’s only at the point the consumer selects and purchasers a particular service or product, that they then get limited and controlled access to the consumers data, within the safety of the YourBlock environment.

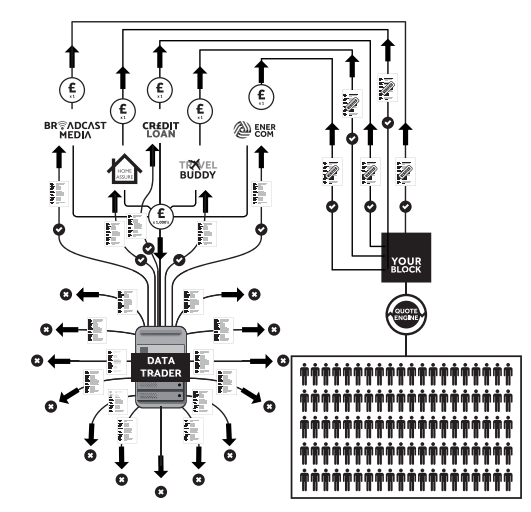

YourBlock aims to disrupt consumer-based service industries, starting with insurance and utility services. The objective is to remove the middle-men such as price-comparison sites by creating an incentivised, Blockchain-based cloud platform that allows for simple, transparent and consistent interactions between consumers and service/product providers.

YourBlock YBK Token Economics

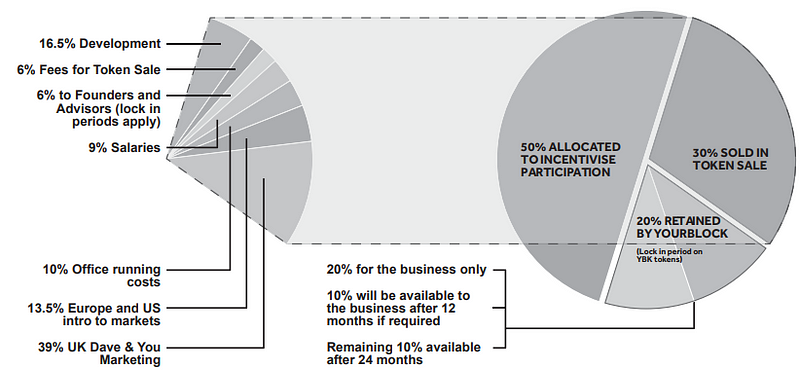

200,000,000 issued YBK Tokens.

YBK Token Value = €0.50.

The number of YBK tokens being released is fi nite (200,000,000) and the YBK tokens will be used as an incentive and reward on the platform. Therefore it is envisaged that YourBlock will have to actively take part in purchasing YBK tokens on a secondary market, in order to meet future demands.

YourBlock will also encourage companies with which it has commercial arrangements to use YBK tokens as a multi product loyalty reward. A secondary market could play an important role in that distribution, and YourBlock will arrange secondary market listings as quickly as possible following the Token Sale.

YourBlock may also charge its commercial partners a small number of YBK tokens to access and make changes to their pricing plans on the YourBlock platform.

YourBlock through Dave & You aims to generate income through product and service providers paying a fee for the consumer purchase of their service or product on YourBlock’s Blockchain platform.

Product and service providers will not need to worry about aspirational quotes, or holding personal and sensitive data on their systems. There will be no large costs from aggregator software platforms holding their pricing and underwriting guides.

Users of the Dave & You App and website will have gone through the process and time to sign up and register, with a full KYC process, and the data they enter in to their own digital fi ling cabinet will in most cases be of a higher quality than that they perhaps might enter in to a price comparison website.

YBK tokens will also be used to incentivise the user to keep all of their data up to date.

The participants of the YourBlock token sale will be able to use their YBK tokens to make purchases of insurance and utility products. If they do not wish to use their tokens to purchase services they can also use their YBK tokens for discounts on the services.

The YBK token works on the economics of participation and collaboration.

Dave & You Participation — As more users participate in the ecosystem by entering more of their and their families personal data, and through this purchasing more services, YourBlock aim to bring more value back to both the consumer and service provider.

The service provider will be getting accurate and real time leads. YourBlock can work to charge a higher fee for the lead and in turn pass back more YBK tokens to the user.

The more users of Dave and You there are, We can arrange bigger discounts on the products and services.

With more participants of Dave & You we can create better ratings of the service providers, which in turn will help not only the users to make a more informed choice of a service or product, but give valuable feedback to the Service Providers, so they can make changes and better their services.

Service Providers will be approached to off er discounted deals that cover more than one service or product to large groups of consumers.

We can analyse the users of Dave & You, through this we can assist them with possible changes they can make with their Service Providers for better deals, not only from a price point, but one that may off er them a better all round service.

Dave & You Collaboration — YourBlock will work toward collaboration between the users and the service providers.

Service Providers will be able to collaborate with users of Dave & You and tailor certain products and services to meet the users requirements.

Users of Dave & You through collaboration can help each other and off er their own advice on the products and services to other users.

Users and Service Providers through collaboration can assist YourBlock in it’s development and usability.

Contracts are smart in terms of showing vital information such as cooling off periods. Reminders are sent to the consumer, cancellation rates and charges are displayed, and renewal dates monitored.

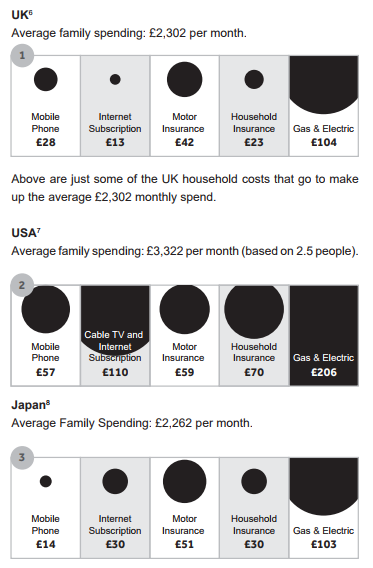

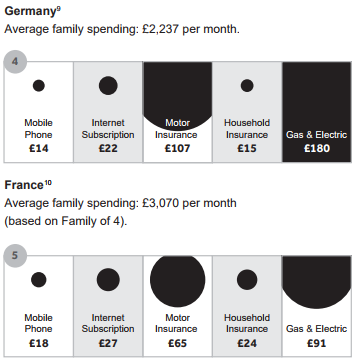

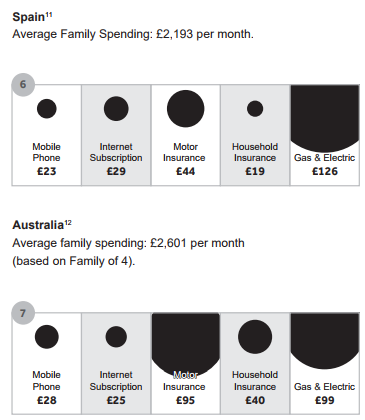

Market Statistics

Average Monthly Household Expenditure — Data below does not include all household expenditure, and is taken from a number of sources and is reported against diff erent periods in time.

Core Details

YBK — YourBlock Token

The YBK token will be rewarded to the consumer in two stages on the Dave & You platform. As the consumer inputs their personal data and documents they will be rewarded with YBK tokens.

Example: Consumer completes all fi elds needed to receive a quote for motor insurance, at this point (provided that they fulfi l the KYC criteria) they will be rewarded with YBK tokens.

Once a consumer purchases a service through Dave & You they will be rewarded with YBK tokens.

YBK Token Sale Terms

YourBlock aims to raise €30 million Euros from the Token Sale. A maximum of €10 million will be taken in the Pre Sale (although the number of tokens to be issued is variable, depending upon the discount level). Those participating in the Pre Sale will be subject to lock in periods, subject to the amount they purchase.

Given Pre Sale discounts, it is likely that more than 60 million YBK tokens will be required for the total YourBlock token sale. Where more tokens are required they will be taken from the Incentive and Reward pool (mentioned below).

The Incentive and Reward Pool will be ring fenced. We will build in an audit element on the Blockchain that clearly shows the YBK tokens passed to consumers who register on the YourBlock platform, enter their data correctly, and then purchase a product on the platform. We will work closely with an audit partner to achieve this.

YBK Supply

- Total token supply = 200 Million (200,000,000) YBK tokens

- 30% of YBK tokens sold to public in the token sale.

- YBK Value = €0.50

- Hard Cap = €30 Million

- Soft Floor = €5 Million

Basic Terms

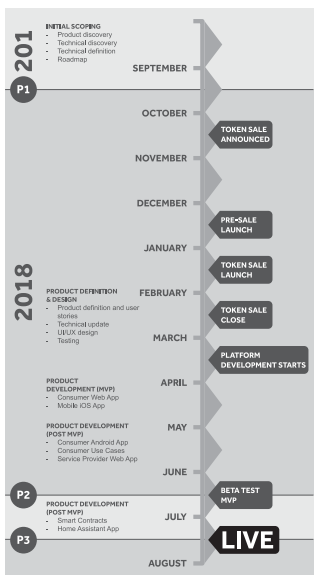

Pre sale start date: 18th December 2017 — €10 Million Discount on pre sale YBK tokens up to 40% Lock in periods will apply

- Pre sale end date: 15th January 2018

- Main sale start date: 15th January 2018

- Main sale end date: 26th February 2018

Milestones

Team and Partners

Daniel Antcliff — CEO and Founder

Daniel has spent over twenty years working in the fi nance and insurance sector, specifi cally looking at how business’ daily operations can be improved and automated through IT solutions. Working closely with end-users, management and senior board, Daniel owns a special skill in translating the business needs to the developers. His approach results in projects managed eff ectively, on time and cost-effi ciently, which results in seeing a return on investment almost immediately.

Ben Antcliff — CMO

Ben has twenty years’ experience in sales management and development in the commercial sector. In 2015, he co-founded two data driven businesses, with year one revenues of over £1.5m and EBITDA of over £300,000. With his clear vision for success, and thorough knowledge of marketing principles, he has successfully managed and built up businesses through theoretical learning and practical experience. His extensive wealth of knowledge in the industry provides a solid foundation to be nimble and fast acting to the changes in data regulation and how best to support consumers and Service Providers, alike.

David Antcliff — CFO

David is a practising accountant and a Chartered Manager. He has been the Managing Partner of a private practice since 1981, having specialised in Mergers & Acquisitions, Corporate re- structuring and Insolvency. His current primary post is Executive Chairman of a leading motor warranty and general insurance business, where he was, since 2005, Group Finance Director. His services were retained by this business in 2000, to undertake the fi nancial due diligence for the acquisition of the RAC Warranty Group of Companies. He has direct responsibility for Finance and Compliance and holds the post of CF1 for FCA purposes.

Mat Brazier — Senior Data Analyst

Mat has over 15 years’ experience in Business Insight/Data Analysis and BI Database development. Initially providing analysis to the Ministry of Defence, Mat has spent the last 9 years working within the insurance industry including motor, life and contents insurance.

Richard Stringer — Business Development Manager

An accomplished, solutions focussed and commercially astute Business and Product Development Director with a wealth of experience delivering sustainable and profi table organic and acquisitive growth as well as enhancing shareholder value, within the Financial Services sector. A prove expertise managing business and product development programmes for internal and external stakeholders, developing product distribution partnerships and added value revenues, acquisitions and disposals, contract and SLA negotiations as well as possessing a sound and robust understanding of the General Data Protection Regulations (GDPR). A strong and infl uential leader building and developing high performing teams, who provides innovative solutions to identifi ed challenges.

Richard Earl — Marketing Strategist

Seasoned marketing, branding and customer acquisition executive having specialised in the digital marketing space for the last 15 years. helping brands across fi nance, insurance, telecoms and retail sectors getting their marketing message and stories across, ultimately fi nding engaged consumers ready to sign up.

Rob Mazik — COM

Rob has over 20 years’ experience in various management roles within the fi nancial sector. Often acting as project leader working and co-ordinating with Stakeholders, Lawyers, IT Specialists, Designers, and Suppliers.

Simon Hewlett — CTO

Simon has spent twenty years overseeing the delivery of high quality, innovative software and reporting solutions to help businesses make better decisions.

Jamie Greenwood — CIO

Jamie has over twenty-fi ve years’ experience in delivering high quality IT solutions to a wide range of organisations.

Matthew Waters — CISO

Matthew is a senior-level executive in information and cyber security, with over 20 years of expertise and leadership in the fi nancial services sector. He specialises in the transformation of information security programmes to meet strategic business change. Throughout his career, Matthew has retained a comprehensive technical knowledge of emerging technologies and threats, enabling him to have a holistic approach to information and cyber security in terms of people, process and technology.

Andy Hague — Cyber Security & Storage Expert

An experienced entrepreneurial and highly fi nancially capable senior executive with a strong technology / GDPR / cybersecurity and secure hosting subject expertise who has built up an impressive track record in turnaround , M&A integration, and rapid growth projects across a variety of diff erent industries and business sizes.

George Higginson — Insurance and Compliance Expert

An insurance professional with a career ranging from the Head Offi ce of the Royal Insurance Group to Underwriter of a Lloyd’s syndicate. After retiring from Lloyd’s, George ran a managing general agency off ering specialist personal insurance products. He remains active in the insurance market as a nonexecutive director of two companies, off ering a range of products aimed at the personal insurance market. He has a very wide range of contacts, is in demand as a consultant and is an FCA regulated individual.

Details Information :

Website : https://yourblock.io/

Whitepaper : https://yourblock.io/wp-content/uploads/2017/12/YourBlock-White-Paper-18-12-2017.pdf

ANN Thread : https://bitcointalk.org/index.php?topic=2716837

Telegram : https://t.me/ybyourblock

Youtube : https://www.youtube.com/watch?v=JIvR9rlDRlY

Facebook : https://web.facebook.com/WeAreYourBlock/?_rdc=1&_rdr

Twitter : https://twitter.com/weareyourblock

Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1116890

Tidak ada komentar:

Posting Komentar