Consisting of experienced professionals from compliance, AML1 , virtual currency2 , blockchain and tech ecosystems, the Coinfirm team came together in 2015 under the vision to bring a new level of transparency and efficiency that serves the entire blockchain ecosystem, spreads its benefits into the traditional economy and enables the mass market to use it safely. Out of that vision the Global Standard that is the Coinfirm AML/CTF3 Platform (also referred to as the ’Platform’) was built.Visit more information Website : https://amlt.coinfirm.io/

AMLT used in the Coinfirm AML/CTF Platform is the missing puzzle to bring virtual currencies into the mainstream in a safe, secure and compliant way. It helps exchanges, payments processors, financial institutions and all players in the financial system to manage the regulatory risk related to blockchain value transfer. It allows network members to provide information, rate other market participants and democratically help determine the related risk to entities and counterparties using virtual currencies.

AML/CTF is connected with risk management, not just simply strict laws, rules and regulations to follow. There is also a degree of internal assessment needed by obliged companies to build a correct risk management model. AMLT helps with compliance in an innovative way while by engaging and providing beneficial participation to the users of virtual currencies.

Vision and Mission

of Coinfirm Coinfirm provides a network that builds a transparent, democratic, effective and compliant virtual currency and blockchain ecosystem. Coinfirm’s goal is to deliver a streamlined and effective Global Standard for AML/CTF compliance in a decentralized and democratic way where participants can provide AML/CTF/Fraud/business/risk ratings whether negative or positive. Not only providing transparency and democratization of the financial system in an unprecedented way, AMLT attached to the Coinfirm AML/CTF Platform serves as a bridge to accommodating new business models and adopting blockchain and virtual currencies.Visit more information Whitepaper : https://amlt.coinfirm.io/pdf/white-paper.pdf

Value proposition

A token that provides access rights to the Coinfirm AML/CTF Platform, AMLT allows users to purchase reports with substantial discounts, gain exclusive access to knowledge, and allows members to evaluate market participants and obtain AMLT by providing data crucial to seamless and safe trade. AMLT is the key that in line with Coinfirm’s Platform provides solutions to problems for all participants in the ecosystem and creates the foundation for a secure, tranparent, democratic and compliant economic system.

There are new entrants on the market that are interested in virtual currencies and bearing similar risks without proper tools:

- Virtual currency exchanges and payment processors

- Hedge funds

- Large companies that want to improve cash management

- International transfer entities (financial institutions)

- Internal Blockchains/Virtual Currencies for large groups

Solution

A solution is needed for virtual currency businesses and traditional businesses that accept virtual currencies or simply want to have exposure to it. At the end of the day, any entity touching virtual currencies or operating with them needs to apply AML/CTF compliance rules to protect themselves, their partners and their clients from potential risks and to allow for its commercial growth.

The solution is here. A global platform that solves these problems for the entire ecosystem in a new, effective and efficient way, that grows with the network it creates and becomes the ‘back bone’ for the ecosystem while running unnoticeably in the background. The entire ecosystem now has a simple and straight forward solution that helps with the compliance for the most sensitive aspect of its businesses.

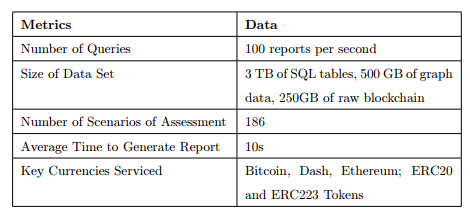

Coinfirm — Select technical metrics and implementations

The ecosystem impacted by the lack of effective and efficient AML/KYC risk management for blockchain transactions covers:

- Companies accepting virtual currencies

- Banks and Financial Institutions

- Business Intelligence Companies

- New ICO’s

- Smart Contracts

- New Market Entrants

- Individuals Globally

A New Deal — Global Standard for AML/CTF Compliance for blockchain based transactions

Due to its characteristics, blockchain, especially public blockchains, are perfect for RegTech and AML/CTF compliance solutions as they deliver the ultimate level of data trust and transparency.

It is evident that in an increasingly digital commercial landscape, the role that solutions such as blockchain will play in facilitating AML/CTF procedures is an inevitability rather than a possibility. The efficiency and transparency with which discrepancies concerning client data can be detected should be commended and supported as consistent scandals and highlights of inefficiency in the current ecosystem shows. The recent alleged involvement of major UK banks such as HSBC, RBS and Barclays in a Russian scandal concerning the movement of approximately £65m highlights that any FinTech developments that can help to expose other crimes of a similar nature should be endorsed.

The Platform decrypts and analyzes data from blockchains in real time. The data collected from blockchains include:

- transaction hash and type (e.g. single/multiple input and output, single/multiple signature)

- transaction input and output blockchain addresses

- transaction value

- balance of funds on blockchain addresses

- transaction timestamp

- fee

- size and message

- address cluster

- Information about the node that approved the transaction and more.

This shows the flow of AMLT in the Coinfirm AML/CTF Platform.

Tokens Distribution during Crowd Sale

- Tokens available to public at launch: 210,000,000

- Data rewards pool for Network Members: 120,000,000 (distributed monthly by the smart contract)

- Consultants/Advisors: 2%

- Ambassadors/Referrals: 1%

- Founding Team: 10% (with lockup period)

- Dev team and bonuses: 4% (with lockup period)

- Foundation/Charity: 0,5%

- Total AMLT Tokens generated in smart contract: 400,000,000

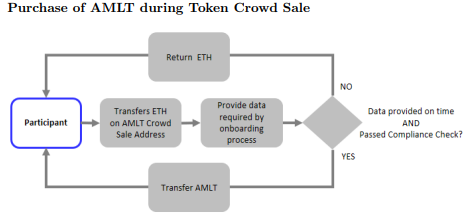

A participant who wants to purchase AMLT during the Token Crowd Sale needs to pass through the onboarding procedure after transferring ETH to the AMLT Crowd Sale Address. The Participant needs to provide for the compliance evaluation Participant’s Profile and Identity Data and Participant’s Ethereum Address from which the payment for AMLT is supposed to be made. In case the Participant does not provide all data required by onboarding process until AMLT Crowd Sale Timeout, providing this data would still be possible within 2 weeks after the Crowd Sale, the documents will be verified within a maximum 4 weeks after the Crowd Sale.

- Access to the Coinfirm AML/CTF Platform and its services (Basic Report, C-Score, Standard Report, and Enterprise Report);

- Access to an exclusive Knowledge Pool including exclusive trainings, webinars, articles, guidance on AML/CTF Compliance but also applicable example policies, procedures and risk matrix’s;

- Possibility of being rewarded in AMLT for contributing data on virtual currency addresses to the Coinfirm AML/CTF Platform.

- Discount % for services on the Coinfirm AML/CTF Platform ;

- Access to the exclusive Knowledge Pool of the Coinfirm AML/CTF Platform;

- Possibility of being rewarded in AMLT for contributing data on virtual currency addresses to the Coinfirm AML/CTF Platform.

Safety of funds and compliance with AML/CTF and KYC regulations

Escrow will be implemented for at least 70% of the funds. AML/CTF and Compliance will be transparently run through the Coinfirm Platform (each AMLT holder will be rated) with other elements outsourced to a trusted third party provider.

Roadmap

- Pre 1.0 AMLT: Coinfirm AML/CTF Platform already provides AML/CTF solutions for the virtual currency ecosystem with global clients and partners ranging from some of the largest virtual currencies to major business intelligence companies and financial institutions. The system can be accessed online or via API. The easily adoptable and user friendly Platform allows users to complete their AML/CTF compliance model with transaction monitoring. The Coinfirm AML/CTF is blockchain agnostic and currently provides services for Bitcoin, Dash, and Ethereum.

- 1.0 AMLT: AMLT becomes the fully transparent access token of the Coinfirm AML/CTF Platform and network where in order to fully use the platfrom buy a report or access the API at discounted rates and access the Knowledge Pool with exclusive webinars, trainings, articles, draft policies, procedures, risk matrix’s on AML/CTF, AMLT and the status of Qualified User or Network Member is required.

- 2.0 AMLT: AMLT Wallet integrated with the Coinfirm AML/CTF Platform. Network Members that went through the identification and verification process on the Coinfirm AML/CTF Platform, obtained approval for a white label address and hold the minimum of amount of AMLT required are able to provide information to the Platform about virtual currency addresses (their own and others) in exchange for participation in the Monthly Distribution of AMLT generated by the smart contract. The contributions will be valued, and transactions will be calculated based on the value of the reported information. This will allow for full user privacy as well as a decentralized audit trail for users to ensure they received the correct payments for their input into the AMLT network.

Team

- Robert Ciurkot — COO at Coinfirm

- Krzysztof Kr´ol — Product Owner

- Marcin Rabenda — Product Owner

- Beata Wi´snicka — Senior AML Analyst

- Pylip Radionov — C++ Developer

- Sebastian Gruza — Java

- Developer Bartosz Zi¸eba — Developer Magdalena

- Poprzeczko — Executive Assistant

- Maksymilian Jaworski — Data Base

- Administrator Lukasz Kranc — Frontend

- Developer Filip Wieczy´nski — Business Developer

Advisors

Pawel Tomczuk, Chairman of the Advisory Board — CEO of JPGH & Associates, entrepreneur, founder of Ciszewski Financial Communications (successfully sold to Publicis Groupe ‘2011), investor & advisor to the board of numerous tech businesses across fintech, digital media and data. Mentor at Techstars, Startupbootcamp Fintech & Insurtech, Startup Grind and London Tech Advocate.

Ruth Wandh¨ofer, Blockchain Regulatory Advisor — Global Managing Director of Compliance & Market Strategy in Citibank, Regulatory and FinTech expert and one of the foremost authorities on banking regulatory matters, Ruth is a recognized global leader in the compliance space and chairs a number of influential industry bodies.

Julian Johnson, Strategic Advisor — CEO of MainSheet Ventures with 25- years of experience in the technology market and global sales executive roles at Oracle, Siebel, SAP, Microsoft and Salesforce. Julian has implemented major systems around the world and built an extensive career spanning several industries, including financial services, public sector, telecommunications and media,utilities and energy.

Details Information :

Website : https://amlt.coinfirm.io/

Whitepaper : https://amlt.coinfirm.io/pdf/white-paper.pdf

Facebook : https://web.facebook.com/AMLToken/?_rdc=1&_rdr

Twitter : https://twitter.com/AMLT_Token

Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1116890

ETH : 0xD21b7600ff11bEfB00dff92252a16A2f2fdBF71a

Tidak ada komentar:

Posting Komentar